The Canadian credit card landscape is a complex ecosystem shaped by the dynamic interplay of three dominant players: Visa, Mastercard, and American Express. Each network brings a unique blend of acceptance, rewards, and security features to the table, making it imperative for consumers to carefully evaluate their options before selecting a credit card.

The widespread acceptance of Visa and Mastercard has solidified their positions as the backbone of the Canadian payment system. Their extensive merchant networks, coupled with a diverse range of card products, cater to a broad spectrum of consumer needs. However, American Express has carved out a distinct niche with its premium card offerings and exclusive benefits, appealing to a more affluent clientele.

Understanding the intricacies of different credit card networks in Canada is crucial for making informed financial decisions. By comparing factors such as acceptance rates, rewards structures, fees, and security features, consumers can select a credit card that aligns with their spending habits, travel preferences, and financial goals.

The Dominance of Visa and Mastercard

Visa and Mastercard have undeniably established themselves as the titans of the Canadian credit card industry. Their extensive merchant acceptance networks, coupled with a diverse range of card products, cater to a broad spectrum of consumer needs.

Visa

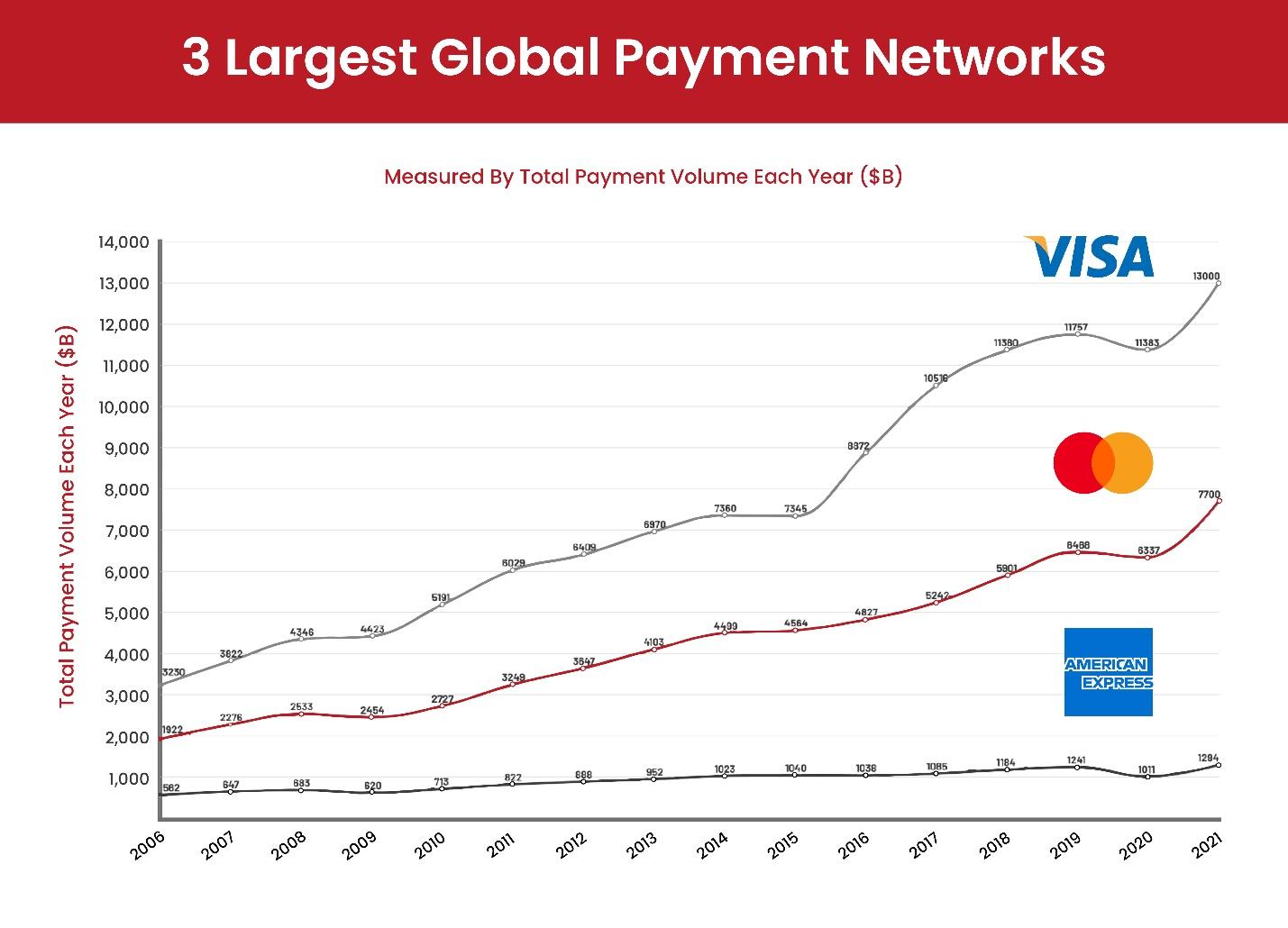

As the world’s largest payment network, Visa boasts unparalleled acceptance, both domestically and internationally. Its vast network of merchants, coupled with a robust suite of credit card offerings, has made it a preferred choice for millions of Canadians. From no-frills cards to premium options with exclusive benefits, Visa caters to a broad spectrum of consumers.

Mastercard

A close competitor to Visa, Mastercard also enjoys widespread acceptance. Known for its technological innovations and partnerships, Mastercard offers a diverse portfolio of credit cards, including co-branded options with popular retailers and travel providers.

The Distinctive Position of American Express

American Express occupies a unique niche in the Canadian credit card market. Renowned for its premium card offerings and exceptional customer service, American Express has cultivated a loyal following among affluent consumers. However, its acceptance network is more limited compared to Visa and Mastercard, particularly in certain retail establishments.

American Express cards often come with exclusive perks, such as travel insurance, concierge services, and access to airport lounges. These premium benefits appeal to consumers who prioritize high-end experiences and are willing to accept the trade-off in terms of acceptance.

Key Differences Between the Networks

Beyond acceptance rates, rewards programs distinguish the three networks.

Rewards

Visa and Mastercard offer a wide range of rewards, including cashback, travel points, and merchandise. American Express typically focuses on travel and lifestyle rewards, catering to a more affluent clientele.

Fees

Annual fees, foreign transaction fees, and other charges can vary significantly between networks and card issuers. It’s essential to compare fees carefully to determine the overall cost of ownership.

Security

All three networks prioritize security, but they employ different technologies and fraud prevention measures. It’s crucial to understand the security features offered by each network to protect your financial information.

Choosing the Right Credit Card Network in Canada

Selecting the best credit card network depends on your individual needs, spending habits, and lifestyle. Consider the following factors when making your decision:

Acceptance

Evaluate where you frequently shop and travel to determine the most suitable network.

Rewards

Assess the rewards offered by different networks and choose the one that aligns with your spending patterns.

Fees

Compare annual fees, foreign transaction fees, and other charges to determine the overall cost.

Security

Consider the security features offered by each network to protect your financial information.

Additional benefits

Explore the additional perks and services provided by each network, such as travel insurance, purchase protection, or concierge services.

The Impact of Technology on Credit Card Networks

The credit card industry is undergoing a rapid transformation, driven by technological advancements. Contactless payments, mobile wallets, and tokenization are reshaping the way we pay. All three major networks are investing heavily in these technologies to enhance security, convenience, and user experience.

Contactless payments, enabled by near-field communication (NFC) technology, have gained significant traction in Canada. Both Visa and Mastercard have been at the forefront of this development, with their contactless cards widely accepted by merchants. American Express has also embraced contactless technology, but its adoption rate might be slightly lower due to its smaller merchant network.

Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, have become increasingly popular. These platforms allow users to store their credit card information securely and make payments with a simple tap of their smartphone. All three major credit card networks support mobile wallets, but there may be variations in terms of supported devices and features.

Tokenization is another technology that is transforming the credit card industry. By replacing sensitive card data with a unique token, tokenization enhances security and reduces the risk of fraud. All three networks have implemented tokenization to protect consumer information.

The Rise of Digital Wallets and Peer-to-Peer Payments

The emergence of digital wallets and peer-to-peer (P2P) payment services is challenging the traditional credit card landscape. These platforms offer convenient and secure ways to make payments, potentially reducing reliance on physical credit cards.

Digital wallets, such as Apple Pay and Google Pay, often integrate credit card information, allowing users to make contactless payments. P2P services, like Interac e-Transfer and PayPal, provide alternatives to traditional credit card transactions for person-to-person payments.

The Future of Credit Card Networks in Canada

The credit card industry is in a constant state of evolution, driven by technological advancements, changing consumer preferences, and increasing competition. As we look ahead, several trends are likely to shape the future of credit card networks:

Biometric authentication

The use of fingerprints, facial recognition, and other biometric data for authentication is expected to become more prevalent.

Blockchain technology

The potential of blockchain to revolutionize the payment industry is being explored, with implications for security, transparency, and efficiency.

Increased competition from fintech companies

Fintech startups are offering innovative payment solutions, challenging traditional credit card companies.

Focus on customer experience

Credit card issuers will prioritize customer satisfaction by offering personalized rewards, enhanced security, and seamless user experiences.

The credit card landscape is dynamic and complex, and consumers must stay informed to make informed decisions. By understanding the key differences between Visa, Mastercard, and American Express, you can select the credit card that best aligns with your financial goals and lifestyle.

Understanding Credit Card Fees

Credit card fees can significantly impact your overall spending. Here’s a breakdown of common fees:

- Annual fee: A yearly charge for using the card.

- Foreign transaction fee: A percentage charged for purchases made outside your home country.

- Balance transfer fee: A fee for transferring balances from other credit cards.

- Cash advance fee: A fee for withdrawing cash from your credit card.

- Overlimit fee: A fee charged if you exceed your credit limit.

- Late payment fee: A penalty for not making your minimum payment on time.

It’s crucial to compare fees across different cards to determine the best value for your money. Some cards offer no annual fees or low foreign transaction fees, while others may have higher fees but offer substantial rewards or benefits.

The Importance of Credit Card Security

Protecting your credit card information is paramount. All three major networks prioritize security, but it’s essential to take additional precautions:

- Strong passwords: Create complex and unique passwords for your online credit card accounts.

- Monitor your account: Regularly review your credit card statements for unauthorized charges.

- Contact your issuer immediately: Report any suspicious activity to your credit card issuer promptly.

- Enable fraud alerts: Sign up for fraud alerts to receive notifications about unusual activity on your account.

- Secure your device: Protect your smartphone and computer with antivirus software and firewalls.

Choosing the Right Credit Card

Selecting the best credit card involves careful consideration of your spending habits, financial goals, and lifestyle. Consider the following factors:

- Rewards: Determine the type of rewards that align with your spending patterns (cashback, travel points, merchandise).

- Fees: Evaluate annual fees, foreign transaction fees, and other charges.

- Interest rates: Compare interest rates if you anticipate carrying a balance.

- Additional benefits: Consider features like purchase protection, extended warranties, and travel insurance.

- Credit score: Some cards may have specific credit score requirements.

By carefully evaluating your options and understanding the nuances of each credit card network, you can select the card that best suits your needs and helps you maximize your financial rewards.

If you’re looking for a credit card that fits your needs and your budget, Great Canadian Rebates is the place to go. They can help you choose the most cost-effective, top-rated cash back credit cards, whether you need a card for online shopping, travel rewards, or simply to manage your finances better. Explore your alternatives and make an informed selection by visiting their Canadian cash back shopping site today.