When it comes to building credit in Canada, responsible credit card usage plays a pivotal role in establishing a solid financial foundation. Whether you’re a first-time cardholder or looking to improve your credit score, understanding the ins and outs of credit cards can help you make the most of your financial journey. By using your card wisely and adopting healthy financial habits, you can boost your credit score over time.

In this blog, we will explore how credit cards can help Canadians improve their credit scores and offer tips for new cardholders on how to develop responsible financial habits. If you’re looking for some of the best credit cards to get started, we will also share a few options and guide you on how to choose the top-rated credit cards that suit your needs.

How Credit Cards Affect Your Credit Score

Credit cards are one of the most effective tools for building credit in Canada, as they help demonstrate your ability to manage debt. When you use a credit card, the issuer reports your payment history to credit bureaus, which affects your credit score. Positive use of a credit card can contribute to a higher score, while missed payments or carrying high balances can lower it.

1. Make Timely Payments

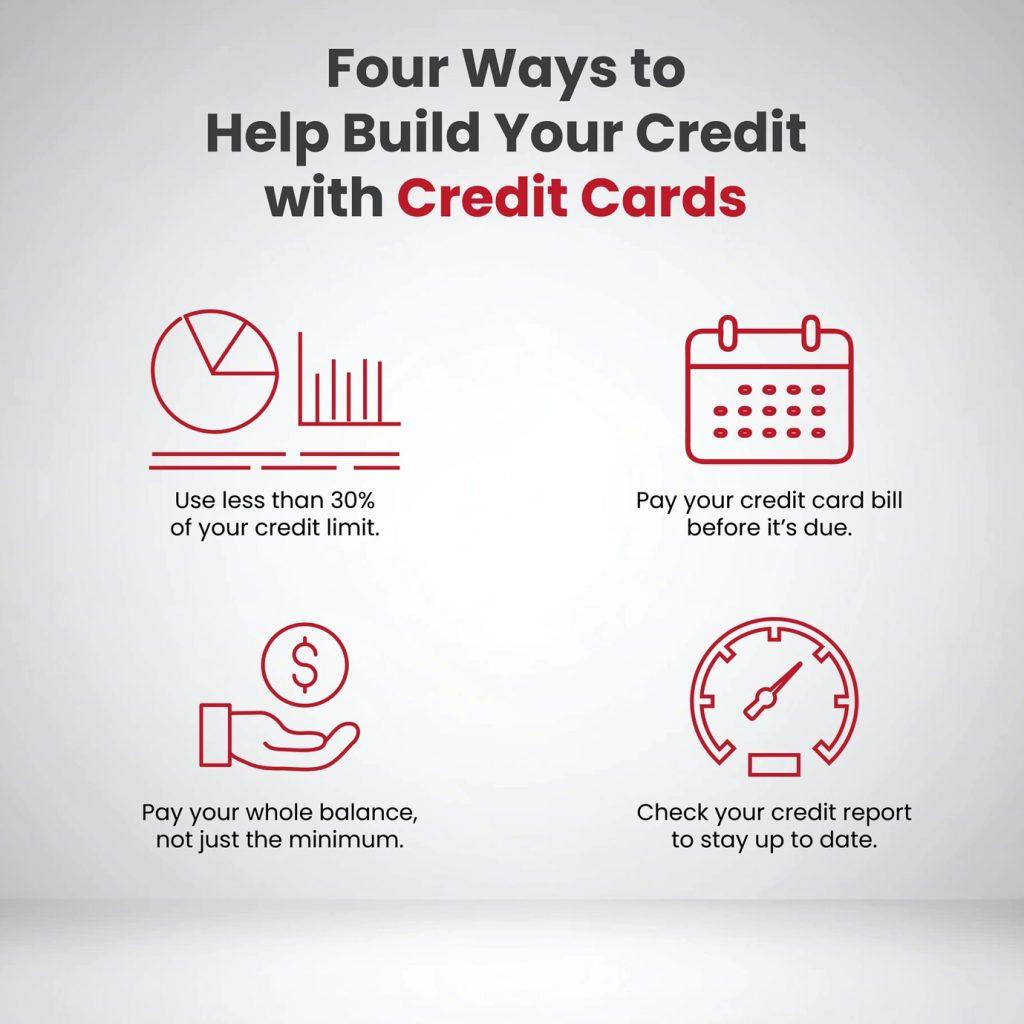

One of the most important factors in building credit in Canada is making your credit card payments on time. Late payments are one of the quickest ways to damage your credit score. Credit bureaus track your payment history, and a single missed payment can stay on your record for years. To avoid this, set reminders for payment dates or set up automatic payments if you can. Paying at least the minimum payment is essential, but it’s even better to pay off your balance in full each month to avoid interest charges.

2. Keep Your Credit Utilization Low

Your credit utilization ratio is the percentage of your credit limit that you are using. For example, if you have a $5,000 credit limit and your balance is $1,000, your credit utilization is 20%. It’s generally recommended to keep your utilization below 30%, as using too much of your available credit can negatively impact your credit score. This shows lenders that you are managing your credit responsibly without relying too heavily on borrowed money.

If possible, try to pay down your balance before your statement date to reduce the amount of credit used. This can help keep your credit utilization ratio in a healthy range and positively affect your credit score over time.

3. Avoid Opening Too Many Accounts at Once

While opening multiple credit cards may seem like a good way to quickly boost your available credit limit, doing so can actually harm your credit score in the short term. Each time you apply for a credit card, the issuer conducts a hard inquiry on your credit report. Multiple hard inquiries within a short period can signal to lenders that you’re taking on too much debt, which could lower your credit score.

Instead, focus on gradually building your credit by applying for one card at a time and using it responsibly. Over time, your credit score will improve as your credit history lengthens and your credit usage patterns become more predictable.

4. Keep Older Accounts Open

The length of your credit history is another important factor in building credit in Canada. The longer you’ve had a credit account open, the more positively it will impact your score. Closing old accounts, especially those with a long history, can shorten your credit history and may hurt your score.

If you’re considering closing a credit card, think twice about closing your oldest accounts, as doing so could negatively affect the average age of your credit history. Instead, focus on keeping these accounts open and in good standing.

5. Use Your Credit Card Regularly

To build credit, you need to demonstrate that you can use credit responsibly. Simply having a credit card without using it regularly will not help you build credit in Canada. Try to make small purchases on your card each month and pay them off in full by the due date. Regular, responsible usage helps establish your credit history and shows that you are capable of managing debt.

Additionally, it’s essential to use your card in a way that reflects your financial habits. For example, if you spend only a small percentage of your credit limit each month, it shows you can use credit wisely without overspending.

6. Pay More Than the Minimum Payment

While paying the minimum payment is better than missing a payment altogether, it’s best to pay more than the minimum each month. If you only pay the minimum, you may end up carrying a balance, which accrues interest over time. Paying down the full balance helps you avoid interest charges and keeps your credit utilization low. This strategy can ultimately help you build a better credit score.

7. Check Your Credit Report Regularly

It’s important to keep an eye on your credit report to ensure it’s accurate. Errors in your report, such as late payments or accounts that don’t belong to you, can negatively impact your score. In Canada, you are entitled to a free credit report from the major credit bureaus such as Equifax and TransUnion once a year. By reviewing your credit report, you can spot and dispute any inaccuracies before they affect your credit score.

If you notice any issues, contact the credit bureau to have them corrected. Regularly monitoring your credit report helps you stay on top of your credit health and identify areas for improvement.

Tips for New Cardholders

If you’re new to credit cards and are looking to build your credit in Canada, here are a few tips to get you started:

- Choose the Right Credit Card: Not all credit cards are created equal. Look for top-rated credit cards that offer benefits aligned with your financial goals. For example, some cards offer rewards programs, while others focus on building credit with lower interest rates or lower fees.

- Start with a Secured Credit Card: If you have no credit history or a limited credit history, consider starting with a secured credit card. With a secured card, you deposit an amount of money as collateral, and your credit limit is typically equal to your deposit. This helps reduce the risk for the lender and can help you build your credit over time.

- Use Your Card Responsibly: Avoid overspending and keep your balance within your means. The more you manage your card responsibly, the faster you will see improvements in your credit score.

- Don’t Rush to Apply for More Credit: As tempting as it may be, refrain from applying for multiple credit cards at once. Each hard inquiry can slightly lower your score, so only apply when necessary.

Best Credit Cards for Building Credit in Canada

Now that you understand how credit cards can help you build credit in Canada, let’s take a look at a few top-rated options that can support your credit-building journey.

- Top-Rated Cash Back Credit Cards: These cards offer rewards for every purchase you make, which can help you save money while building credit. With cash back credit cards, you can earn money on everyday expenses, which can help offset your monthly payments.

- Platinum Card Amex Canada: The Amex Platinum card is one of the most prestigious cards available. It offers high-end benefits like travel rewards, exclusive access to events, and top-tier customer service. Though this card may have a higher annual fee, its perks can help you save money on travel and entertainment while helping you build credit.

- Marriott Bonvoy Credit Cards: If you’re someone who enjoys travelling, the Marriott Bonvoy credit card could be a great option. It earns rewards that can be redeemed for free hotel stays and other travel perks. Plus, responsible use can help you build credit while enjoying travel benefits.

- Amex Business Platinum Card: For business owners, the Amex Business Platinum card offers excellent rewards and features tailored to help manage business expenses. Whether you’re travelling for business or purchasing office supplies, this card can help boost your credit while offering valuable rewards.

- Amex Gold Credit Card: This card offers a range of benefits, including generous rewards on everyday spending categories like dining and groceries. It’s a great option for anyone looking to earn rewards while improving their credit score.

Keen to Learn More About Credit Cards Cash Back?

To explore more options and find the best credit cards for your needs, visit Great Canadian Rebates. Our informational site can help you discover the top-rated credit cards in Canada, including cash-back cards, travel rewards cards, and more. Find the credit card with the most benefits and one that works best for your financial goals.

If you’re ready to start building your credit today then wait no further! Visit the Great Canadian Rebates website now to learn more and begin your journey to building credit in Canada!