It always seems to happen at the worst possible time. You’re juggling work, family, maybe planning for a trip, or trying to catch a sale with your cash back card. Amidst the whirlwind of responsibilities, you miss your credit card payment due date by just one day. You shrug it off, thinking it’s not a big deal.

But days later, you notice something strange: your minimum payment just went up, your interest charges are skyrocketing, and worse, your credit score took a hit.

The reality is that even a single missed credit card payment in Canada can trigger a series of frustrating and expensive consequences. The good news? With the right knowledge and strategies, you can minimize the damage and protect your financial health.

Let’s dive into exactly what happens when you miss a payment — and more importantly, how you can avoid repeating the mistake.

The Immediate Consequences of Missing a Credit Card Payment

The moment your credit card payment due date passes without at least the minimum amount being paid, the clock starts ticking. Canadian credit card issuers do not offer much of a grace period. Even if you miss it by a single day, your payment is technically late.

The first thing you will notice is a late fee applied to your account. This fee typically ranges from $25 to $40, depending on your card issuer. If you’re using a top-rated cash back credit card like an Amex cash back card, it can feel even more painful knowing that a simple mistake is eating away at your hard-earned rewards.

Worse still, your account will lose its interest-free grace period. Normally, when you pay your balance in full each month, you are not charged interest. But after a missed payment, you could be charged interest immediately on new purchases, not just on the outstanding balance.

How Missing Payments Impacts Your Credit Score

If your payment is overdue by more than 30 days, your credit card provider will report the delinquency to Canada’s two major credit bureaus: Equifax and TransUnion.

This is where missing a credit card payment gets serious.

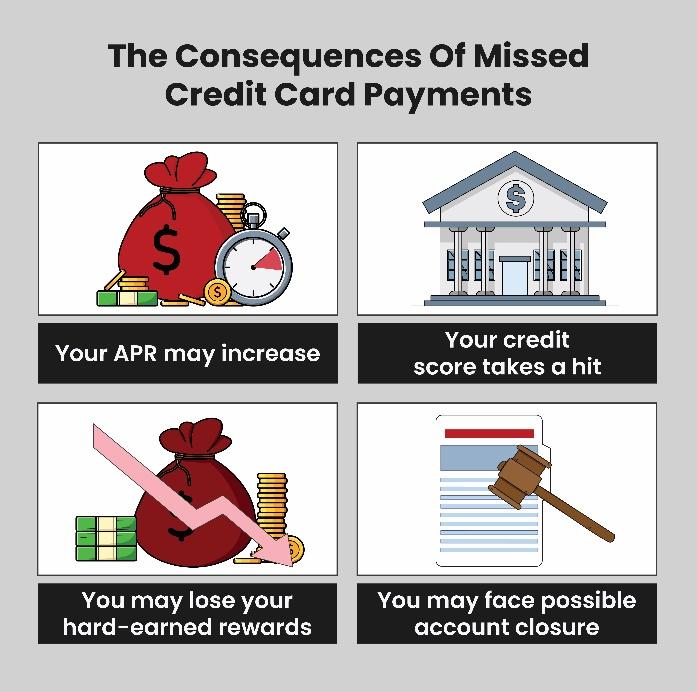

Your credit score — that crucial three-digit number that lenders use to gauge your trustworthiness — could drop dramatically. In Canada, a single late payment can lower a good score (above 700) by as much as 100 points.

Since your payment history accounts for about 35% of your overall credit score, it’s one of the most important factors. This drop can affect your ability to qualify for future loans, secure the best interest rates, and even rent an apartment.

And the damage is not short-lived. Late payments can remain on your credit report for up to six years.

Rising Interest Rates and the Penalty APR

If missing a payment wasn’t bad enough, most credit card companies will hit you with something called a penalty annual percentage rate (APR).

This is a much higher interest rate — often between 25% and 30% — that kicks in if your account is 60 days or more past due.

Suddenly, that shopping spree where you used your cash back card or earned Amex cash back becomes far less rewarding. Instead of celebrating your rewards, you find yourself scrambling to pay off rapidly growing debt.

And once your penalty APR is triggered, it can take six months of on-time payments before your card issuer considers lowering your rate again.

Other Potential Consequences: Losing Rewards and Account Closure

One often overlooked consequence of missing a credit card payment is the potential for issuers to freeze or even forfeit your hard-earned rewards. Many people spend months diligently accumulating rewards through top-rated cash back credit cards or racking up significant points on their American Express cash back cards. However, a single missed payment can put all of that effort in jeopardy, possibly wiping out your rewards entirely.

In more extreme scenarios, particularly if your account becomes seriously delinquent, your credit card issuer may take the drastic step of closing your account altogether. This action can have far-reaching repercussions, as it not only affects your ability to utilize the card but also looks detrimental on your credit report, thereby hurting your overall credit score. A lower credit score can increase your interest rates and make it more challenging to acquire new credit in the future.

It creates a downward spiral that can be difficult to escape unless you take proactive measures to address the situation promptly. It is crucial to stay on top of your payment due dates and manage your credit responsibly to protect your financial health and retain your rewards. Understanding the full implications of missed payments can help you avoid these pitfalls.

How to Mitigate the Impact of a Missed Payment

If you realize you’ve missed a credit card payment, do not panic. There are immediate steps you can take to reduce the damage.

First, make the missed payment as soon as possible. Even if you can only afford the minimum payment, do it. The faster you act, the less likely you are to suffer serious consequences like penalty APRs or credit report damage.

Next, contact your credit card company. Many issuers offer “courtesy waivers” for the first late payment, especially if you have a good history with them. You might be able to get the late fee reversed and avoid a ding to your credit report.

Setting up automatic payments is another wise strategy. Whether you’re using a traditional cash back card or aiming to maximize your Amex cash back earnings, automating your minimum payments ensures you never miss a due date again.

Smart Strategies to Manage Your Credit Card Payments

Managing your credit card payment schedule effectively is crucial to maintaining good financial health.

One effective method is budgeting with your statement dates. If you align your major purchases with the start of your billing cycle, you give yourself more time to pay them off interest-free.

Additionally, consider paying your bill multiple times a month rather than waiting for the due date. Smaller, more frequent payments can help you avoid a large bill shock and keep your balance low.

Choosing a top-rated cash back credit card with strong customer service support can also be a lifesaver. Cards like Amex cash back products often offer flexible payment plans if you hit a rough patch.

Remember, managing your credit card payment wisely is not just about avoiding penalties — it’s about building habits that help you maximize rewards, safeguard your credit, and stay in control of your financial future.

What If You Simply Cannot pay?

Life happens. Job loss, illness, family emergencies — sometimes you genuinely cannot make your credit card payment.

Ignoring the situation is the worst choice. Instead, be proactive and contact your credit card issuer to explain your situation.

Many banks in Canada offer hardship programs that can temporarily reduce your interest rate, waive late fees, or structure manageable payment plans.

Another option is to work with a non-profit credit counselling agency. These organizations can help you negotiate with creditors and set up a formal debt management plan if necessary.

Consolidating your debt into a lower-interest loan can also be an option, but proceed with caution and make sure it fits your long-term financial plan.

The Long-Term Value of Paying On Time

Paying your credit card payment on time every month may seem like a basic financial chore, but its long-term benefits are huge.

It strengthens your credit profile, helping you qualify for better rates on mortgages, car loans, and lines of credit.

It boosts your eligibility for premium cash back cards and top-rated cash back credit cards that offer better perks, higher rewards, and valuable welcome bonuses.

Most importantly, it gives you peace of mind. You’ll never have to worry about collection calls, penalty interest rates, or lost rewards. Instead, you can focus on using tools like Amex cash back cards to enhance your financial life, not complicate it.

Final Thoughts: Mistakes Happen — But You Have the Power to Fix Them

Missing a credit card payment in Canada is not the end of the world. Almost everyone forgets or slips up once in a while.

What matters most is how you respond. Take immediate action, communicate with your lender, and put safeguards in place to prevent it from happening again.

By building smart habits, staying organized, and using your cash back card or top-rated cash back credit cards strategically, you can stay ahead of the game and enjoy all the benefits that credit can offer, without the stress.

Financial success is not about being perfect; it’s about making informed, confident choices. Starting with your very next credit card payment, you can put yourself firmly on the path toward financial freedom.

Where to Apply?

If you plan to apply for a cash back rewards credit card, head to Great Canadian Rebates. The online platform will allow you to compare the best cash back credit cards, which will help you choose the one that fits the bill. You can earn a solid credit card rebate when you sign up for the credit card through the platform.