On a brisk morning in Toronto, Sarah dashed into her local café, craving her usual double-double. With a line snaking behind her and time ticking, she reached for her wallet but paused. Instead, she tapped her credit card against the terminal. A beep, a green light, and she was on her way. No PINS, no signatures—just a seamless transaction.

This everyday convenience is thanks to contactless payment technology, which has transformed the way Canadians shop. From bustling urban centres to quaint rural towns, tapping to pay has become second nature.

The Rise of Contactless Payments in Canada

Canada has emerged as a leader in embracing contactless payment methods, revolutionizing the way people engage in transactions. With the rise of digital technology, Canadians have enthusiastically adopted these quick and convenient payment options.

According to Visa, contactless payments can now be used at millions of locations worldwide, ranging from bustling fast-food restaurants to cozy coffee shops and everyday grocery stores. Retail pharmacies and even vending machines have joined the movement, making it easier than ever for consumers to pay with just a tap.

Imagine standing in line at your favourite café, your mind on that perfect morning brew, and instead of fumbling for cash or searching for your card, you tap your smartphone or card on the payment terminal. This seamless experience not only saves time but also enhances everyday transactions, allowing people to focus more on what they love rather than on how they pay.

Furthermore, in a world where hygiene and safety have become paramount, contactless payments offer an added layer of convenience by minimizing physical contact. As more individuals experience the ease of contactless transactions, it’s clear that this payment method is not just a passing trend but a significant shift in our financial landscape. Embracing this change signifies a step toward a more efficient and user-friendly approach to handling money.

Understanding NFC Technology

Near Field Communication (NFC) is an innovative technology that facilitates contactless payments, revolutionizing the way we make transactions in our daily lives. This system enables devices such as credit cards, smartphones, and smartwatches to communicate seamlessly with payment terminals when they are in close proximity, usually within a distance of just a few centimetres. The convenience offered by this technology allows users to complete their purchases quickly and efficiently without the need to physically swipe their card or enter their PIN at the terminal.

One of the significant advantages of NFC technology is the speed at which transactions can occur. With a simple tap of a smartphone or card on a compatible payment terminal, users can perform transactions in mere seconds. This instant processing time is particularly beneficial in busy environments like retail stores, public transportation systems, and cafes, where customers appreciate the ability to complete their purchases quickly, helping to reduce wait times.

Furthermore, NFC technology prioritizes security, ensuring that each transaction is not only fast but also secure. The data transmitted during an NFC transaction is encrypted, making it difficult for unauthorized parties to intercept or misuse any information. Each transaction generates a unique code, which adds an additional layer of safety by preventing the reuse of data.

As more establishments and services adopt NFC technology, its prevalence continues to grow. Support for mobile wallets like Apple Pay, Google Pay, and Samsung Pay has become increasingly widespread, allowing users to store multiple payment methods securely in their devices.

As a result, NFC is not only streamlining the payment process but is also contributing to a shift towards a more cashless society, where convenience, speed, and security are paramount in financial transactions. This evolution in payment technology highlights how NFC is set to shape the future of commerce in both everyday and specialized settings.

How to Use Your Credit Card for Contactless Payments

Using your credit card for contactless payments is straightforward:

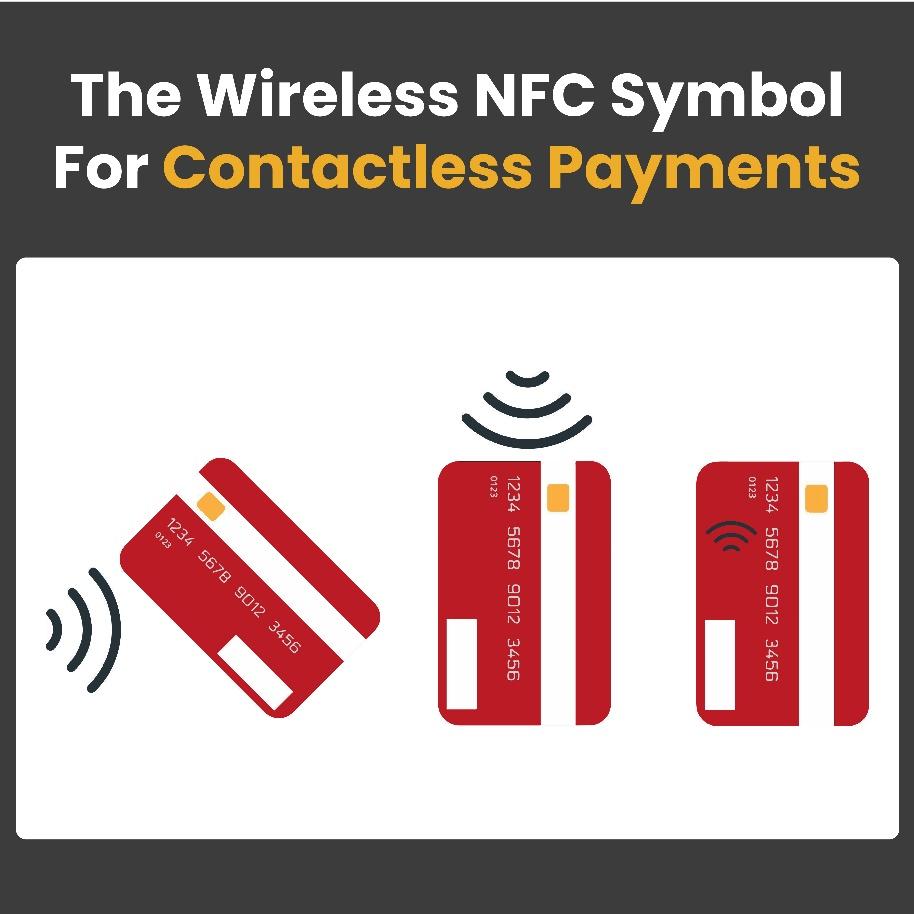

- Check for the Contactless Symbol: Ensure your card has the contactless symbol, which looks like a series of curved lines.

- Look for Compatible Terminals: At the checkout, look for the same symbol on the payment terminal.

- Tap and Go: Hold your card or device close to the terminal until you see a confirmation. There’s no need to enter a PIN for transactions under a certain limit, making the process swift and hassle-free

Benefits of Contactless Payments

Speed and Convenience

One of the most noticeable advantages of using contactless payments is the speed. Unlike traditional payment methods that involve swiping or inserting your card, entering a PIN, and waiting for the system to approve the transaction, contactless technology streamlines the entire process. All it takes is a simple tap of your card or mobile device on the terminal, and you’re done in seconds.

This rapid transaction time can make a significant difference in high-traffic environments such as grocery stores, coffee shops, convenience stores, and public transit systems. In fact, transit authorities in major Canadian cities like Toronto and Vancouver have widely adopted contactless systems because they speed up boarding times and reduce delays. Whether you’re grabbing lunch on your break or rushing to catch a bus, tapping to pay ensures you’re not held up at the checkout.

For merchants, the quicker processing also means they can serve more customers in less time, an essential perk in today’s fast-paced retail landscape.

Enhanced Security

Contactless payments are not just about speed—they’re also about security. Each transaction uses a unique, encrypted code that cannot be reused. This dynamic data makes it incredibly difficult for fraudsters to duplicate or intercept your information, even if they attempt to scan your card.

Additionally, one of the biggest vulnerabilities in card fraud—handing your card to someone else—disappears with contactless payments. Since you always keep your card or smartphone in hand, the risk of card skimming or cloning is dramatically reduced. Most Canadian banks also offer zero liability protection, ensuring you won’t be held responsible for unauthorized transactions.

Hygiene

Since the COVID-19 pandemic, hygiene has become a much greater priority in everyday life. Contactless payments help reduce physical contact with commonly touched surfaces, such as keypads, cash, and card readers. Whether you’re tapping your credit card, smartphone, or smartwatch, you’re reducing your exposure to germs and helping to create a safer, cleaner transaction experience for everyone involved.

In today’s world, where safety, efficiency, and cleanliness matter more than ever, the case for contactless payments is stronger than ever.

Maximizing Rewards with Contactless Payments

Using your credit card for contactless payments doesn’t just offer convenience—it can also help you earn rewards. Many top-rated cash back credit cards offer incentives for using contactless payments.

For instance, the Amex SimplyCash Preferred Card offers a flat-rate Amex cash back on all purchases, making it ideal for everyday spending. Similarly, the TD Cash Back Visa Infinite Card provides enhanced cash back on groceries and recurring bills, which can be easily paid using contactless methods.

By consistently using your cash back card for contactless transactions, you can accumulate rewards effortlessly, turning everyday purchases into tangible benefits.

Setting Up Mobile Wallets

Beyond the traditional use of physical cards, mobile wallets such as Apple Pay, Google Pay, and Samsung Pay provide an innovative layer of convenience for everyday transactions. These digital platforms securely store your card information, eliminating the need to carry multiple cards in your wallet. With mobile wallets, you can make payments effortlessly using just your smartphone or smartwatch, which not only speeds up the checkout process but also adds a layer of security.

Setting up these mobile payment applications is typically straightforward and user-friendly. To get started, you need to download the app associated with your chosen wallet and add your card details. This usually involves entering your card number, expiration date, and security code, followed by a quick verification process to confirm your identity. Once this is complete, you’ll be ready to enjoy the ease and efficiency of tap-and-pay transactions.

Additionally, these mobile wallets often include features like transaction history, spending alerts, and rewards programs, which can help you manage your finances more effectively. The convenience of having your payment methods right at your fingertips can enhance your shopping experience, making everyday purchases quicker and more secure than ever before. Overall, embracing mobile wallets can lead to a more streamlined and efficient way to handle your finances.

Tips for Secure Contactless Transactions

- Monitor Your Statements: Regularly check your credit card statements to ensure all transactions are legitimate.

- Set Transaction Alerts: Many banks offer real-time alerts for transactions, helping you detect any unauthorized activity promptly.

- Use Trusted Devices: Only add your card information to secure, trusted devices to minimize the risk of data breaches.

The Future of Contactless Payments in Canada

As technology continues to evolve, contactless payments are expected to become even more prevalent. With the integration of biometric authentication and the expansion of NFC-enabled devices, the ease and security of these transactions will only improve. Canada’s commitment to embracing innovative payment solutions positions it as a leader in the global shift towards a cashless society.

Where To Apply For The Best Canadian Credit Cards?

Great Canadian Rebates is an online platform that allows members to compare credit card options available in Canada and apply for the one that best suits their financial and lifestyle needs. It’s free to join, and Members can also choose from over 700 well-known merchants and take advantage of great rebates, deals, and discounts.