People often overlook credit scores, but they can have a major impact on your financial future. A good credit report is a requirement for applying for a car loan, a student loan, or a mortgage loan. Sometimes, your credit report can be required for renting an apartment or getting a job involving money management. A Poor credit report could lead to a higher interest rate on a loan or credit card.

To determine your creditworthiness, lenders look at your credit report available to lenders through Equifax and TransUnion.

What is a credit score?

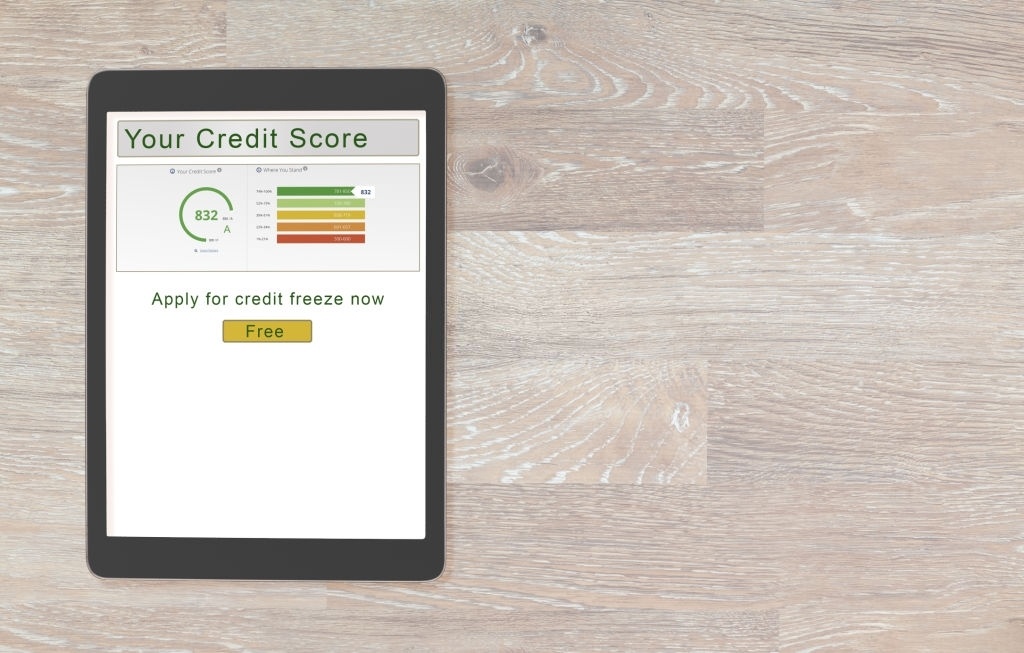

The credit score is a rating that ranges from 300 to 900 and serves to indicate a customer’s payment profile. The number is the result of varying weights given to certain factors.

Basically, the closer the score is to 300, the greater the risk of default. When the number is close to 900, on the other hand, it means the customer has a good track record and is more likely to stay within payment deadlines.

Today, it is used by several institutions and serves as a reliable parameter to compare the information.

A credit scoring agency typically calculates credit scores. These agencies closely monitor individuals’ repayment patterns (bank loans, credit cards, lines of credit, etc.). TransUnion and Equifax are two of Canada’s credit reporting agencies.

Credit scores fluctuate on a scale of 300 to 900 points, with the best score being 900 points. However, with Transunion, the credit score fluctuate from 300 to 850.

What are the factors used to calculate your credit score?

Your score is determined by several factors, including:

1. Payment history

That is undoubtedly the most crucial factor. It includes your late or missed payments, debts claimed by creditors and written off or transferred to a collection agency, and whether you declared bankruptcy.

2. Use of available credit

Even if you pay off your entire balance by the due date, lenders are more likely to be concerned if you use a high percentage of your credit limit.

Try to use less than 35% of your available credit. For example, if you have a credit card with a limit of $10,000 and a line of credit with a limit of $15,000, you have a credit of $25,000. Try to never borrow more than $8,750 (35% of $25,000).

3. The period covered by the credit history

The longer you open and use your account, the better your credit score

In conclusion

Your credit score informs your future creditors about your creditworthiness and money management skills. You may be unable to obtain a loan when you have a poor credit report. The good news is that changing your habits and adopting financial optimization strategies can improve your credit rating.

If you find an error in your file and wish to correct it, contact Equifax Canada or TransUnion Canada as soon as possible, supporting your request with relevant supporting documents such as your bank statement. To correct any errors or for more recent information, you can also contact your creditors directly.